In November 2022, a total of 79,935 new energy vehicles (65,338 pure electric vehicles and 14,597 plug-in hybrid vehicles) were sold in the United States , a year-on-year increase of 31.3%, and the penetration rate of new energy vehicles is currently 7.14%. In 2022, a total of 816,154 new energy vehicles will be sold, and the annual volume in 2021 will be about 630,000, and it is expected to be about 900,000 this year.

I want to spend some time looking at the US market, and also to see whether Biden can develop new energy vehicles in the United States after such a toss.

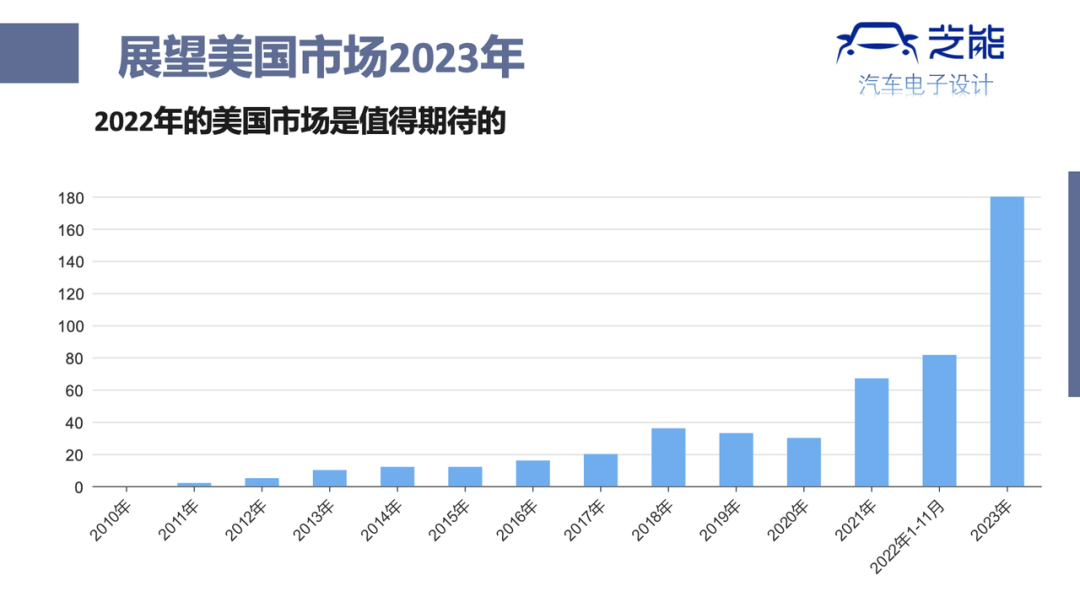

▲Figure 1. The development of new energy vehicles in the United States from 2010

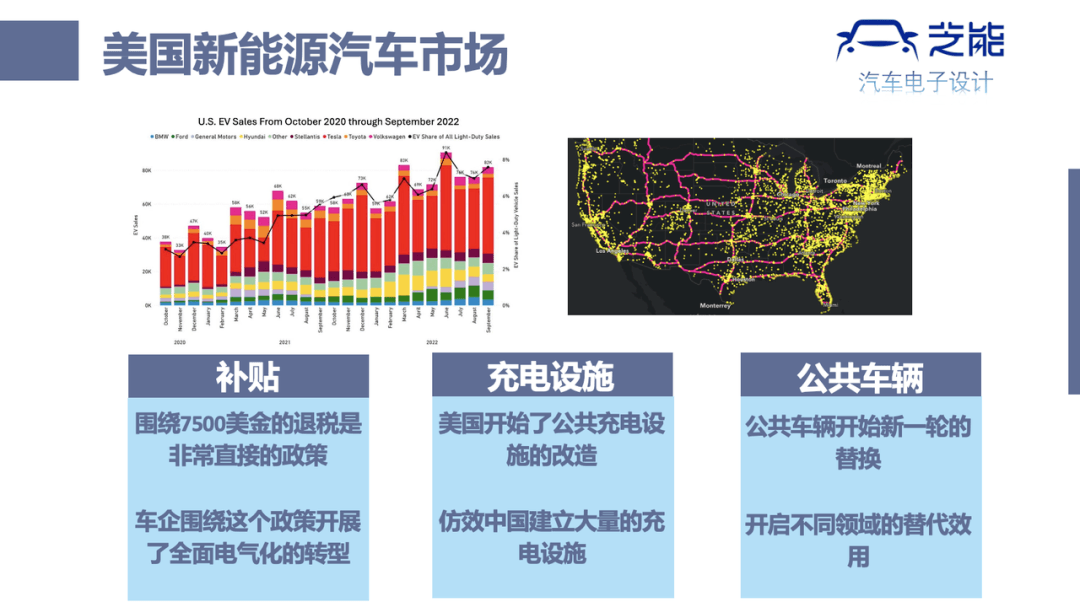

The Inflation Cut Act invests $369 billion to fight climate change and will focus on supporting the development of electric vehicles, and we see that this policy also captures the focus.

◎ New car tax relief: Provide a tax credit of US$7,500 per vehicle, and the subsidy is valid from January 2023 to December 2032. Cancel the previous subsidy limit of 200,000 vehicles for automakers.

◎ Used cars (less than $25,000) : The tax credit is 30% of the sales price of the old car, with a cap of $4,000, and the subsidy is valid from January 2023 to December 2032.

◎The tax credit for new energy charging infrastructure is extended to 2032, up to 30% of the cost can be credited, and the upper limit of the tax credit has been raised from the previous $30,000 to $100,000.

◎$1 billion to clean heavy vehicles like school buses, buses and garbage trucks.

▲Figure 2. The starting point for the development of new energy vehicles in the US market

Part 1

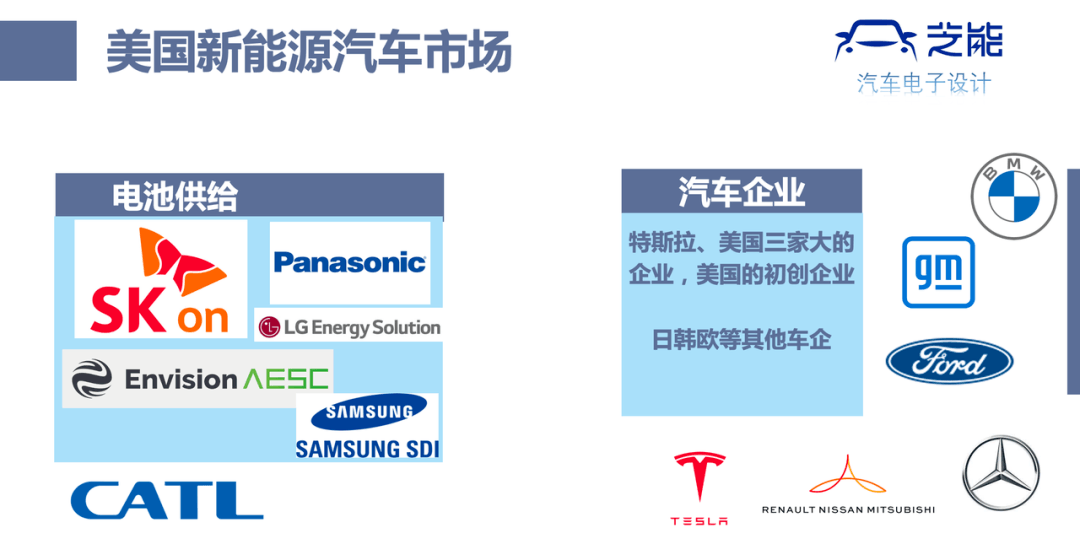

New Energy Vehicle Supply in the US Market

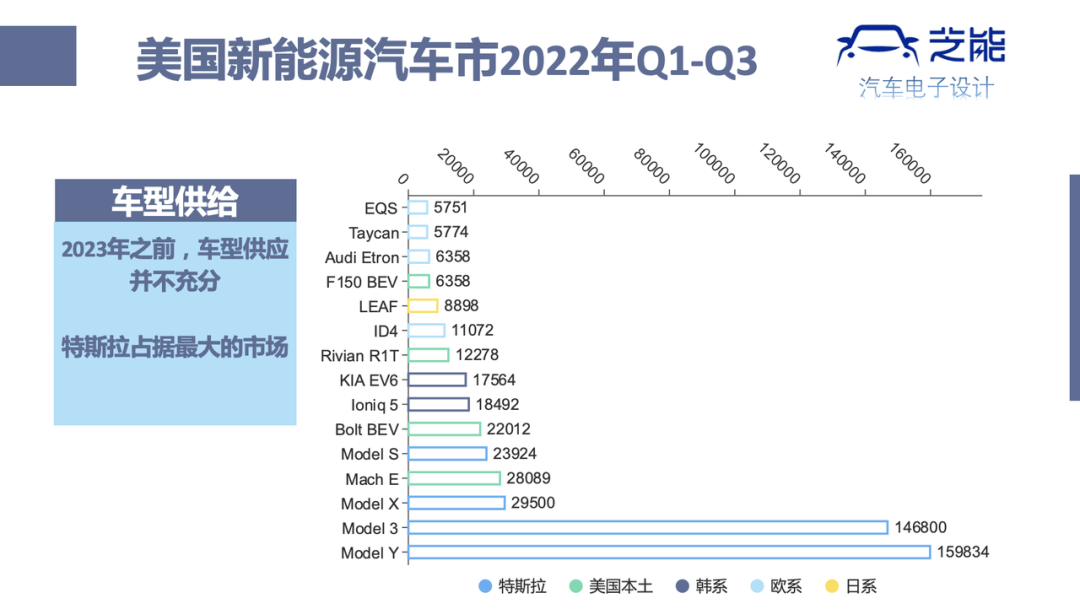

From the perspective of product supply, the US market is very scarce, so that Nissan’s LEAF is currently in the forefront.

▲ Figure 3. Product supply in the US market

● General Motors

Due to product recalls, General Motors’ volume in 2022 will be relatively small. The planned production capacity in 2025 is 1 million, and it is expected to produce 600,000 units. Therefore, in 2023, products including EQUINOX pure electric, Blazer EV, etc. will be launched one after another, so the goal of 1 million in 2023-2025 must be achieved, so next year may It can go to 200,000, and the output of Bolt BEV is clearly going to 70,000 vehicles.

2023 is still a transitional period for GM. With the start of production at the joint venture battery factory, the entire volume is acceptable. Since the bill splits the tax credit into two equal parts of USD 3,750/vehicle, localized assembly requirements are proposed for the batteries used in electric vehicles and the key materials and core components used:

◎ The first $3,750/car subsidy: 40% of the value of key battery materials(including nickel, manganese, cobalt, lithium, graphite, etc.)is extracted or processed by the United States or countries that have signed free trade agreements with the United States, or recycled in North America(2023 ), the proportion will increase by 10% every year from 2024 to 80% by 2027.

◎ Second US$3,750/car subsidy: more than 50% of the value ofbattery components(including positive and negative electrodes, copper foil, electrolyte, battery cells, and modules)(2023), 2024-2025 The proportion is greater than or equal to 60%, and the proportion will increase by 10% every year from 2026, reaching 100% by 2029.

Therefore, GM can achieve a subsidy of 3,750 US dollars here.

▲ Figure 4. General Motors Product Portfolio

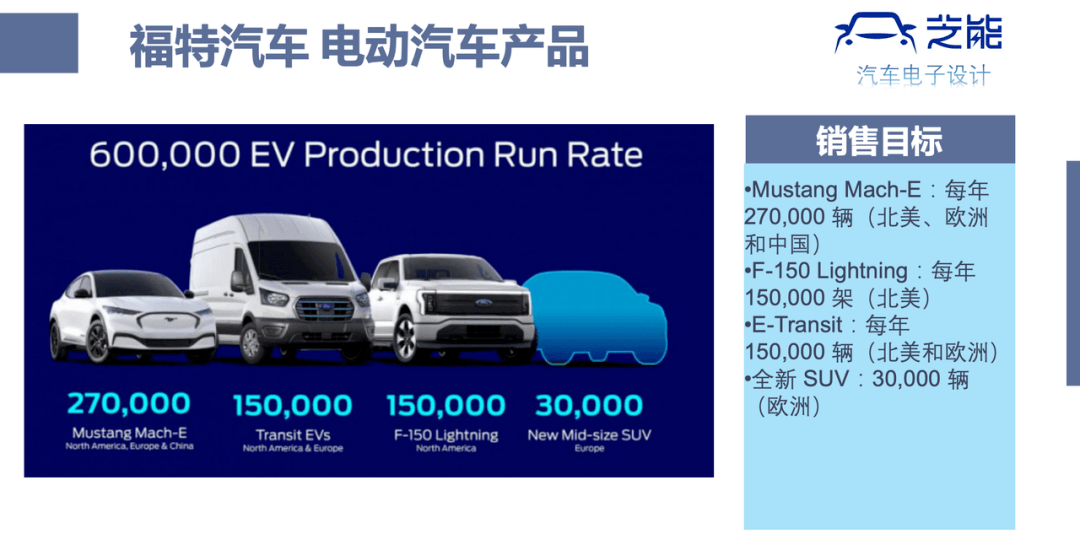

● Ford

Ford plans to have an annual global production capacity of about 600,000 electric vehicles by the end of 2023 and more than 2 million vehicles by 2026. Therefore, from the perspective of segmentation, Ford’s sales in the United States may exceed 450,000 units in 2023.

◎ Mustang Mach-E: 270,000 units per year(North America, Europe and China, the United States may account for 200,000 units).

◎ F-150 Lightning: 150,000 per year(North America).

◎ E-Transit: 150,000 units per year(North America and Europe, estimated 100,000 units in the US).

◎ New SUV: 30,000 units(Europe).

▲ Figure 5. Ford’s production capacity planning

Stellantis is now divided into two parts. The original Chrysler part. From the current point of view, North American batteries are not ready yet. It may still be dominated by plug-in hybrids in 2023, which may greatly strengthen the plug-in power in the United States. The amount of electric hybrid in 2023.

◎Dodge released its first plug-in hybrid model HORNET, built on the Alfa Romeo Tonale shared platform, this time launched a total of HORNET R/T plug-in hybrid.

◎Jeep released its first pure electric model Avenger, starting from a small pure electric SUV model (this is not sold in the United States) , the first pure electric model launched in North America will be a large SUV called Recon (2024 began production of the Recon in the United States) .

▲ Figure 6. Stellantis new energy vehicle portfolio

The products of Japan and South Korea all involve a subsidy for assembly in North America.

Part 2

Practical constraints on subsidies

Since the U.S. subsidy first sets preconditions, they must be met at the same time to be eligible for declaration:

◎New cars must be assembled in North America.

◎From 2025, key minerals for batteries shall not be extracted, processed or recycled by foreign entities of concern listed in the Infrastructure Investment and Employment Act; from 2024, battery components shall not be manufactured or assembled by foreign entities of concern.

◎ Vehicle price requirements: limited to electric trucks, vans and SUVs priced at no more than $80,000, and sedans priced at no more than $55,000.

◎ Income requirements for car buyers: the total personal income limit is US$150,000, the head of household is US$225,000, and the joint filer is US$300,000.

For Tesla owners in California, USA, this condition may not be met. The overall effect this time is to look at the three major US General Motors, Ford and Stellantis (Chrysler) . Therefore, next year’s increase will be There will be an uptick in Tesla, and these three companies will see the largest increase in vehicle demand. Therefore, the current problem in the U.S. market is stuck in battery production capacity. Unlike Europe, which began to encourage the growth of vehicles, local battery production capacity lags behind. This time, the U.S. seized car companies and let them develop local battery production capacity. method.

It is assumed that the total number of electric vehicles in 2023 may not be as high as the expected 1.8 million, mainly due to the fact that the production capacity of the battery cannot keep up. Therefore, in 2023-2025, the sales volume of the entire electric vehicle can be estimated based on the increase in battery production capacity in North America. This is a very important observation point.

▲ Figure 7. The battery in the United States has become the core issue

Summary: At present, China’s new energy vehicle market is actually ahead of the world for several years. Due to the large volume, we are transitioning to marketization, and we really need to go out in this process. But when we go to these markets, which are several years behind us and are still entering the incubation period with government funds, we are bound to encounter fierce resistance. This is the same reason as when we spent money a few years ago, we didn’t want foreign cars and foreign batteries to get subsidies. In different time rhythms, how to operate requires some wisdom!

Post time: Jan-03-2023