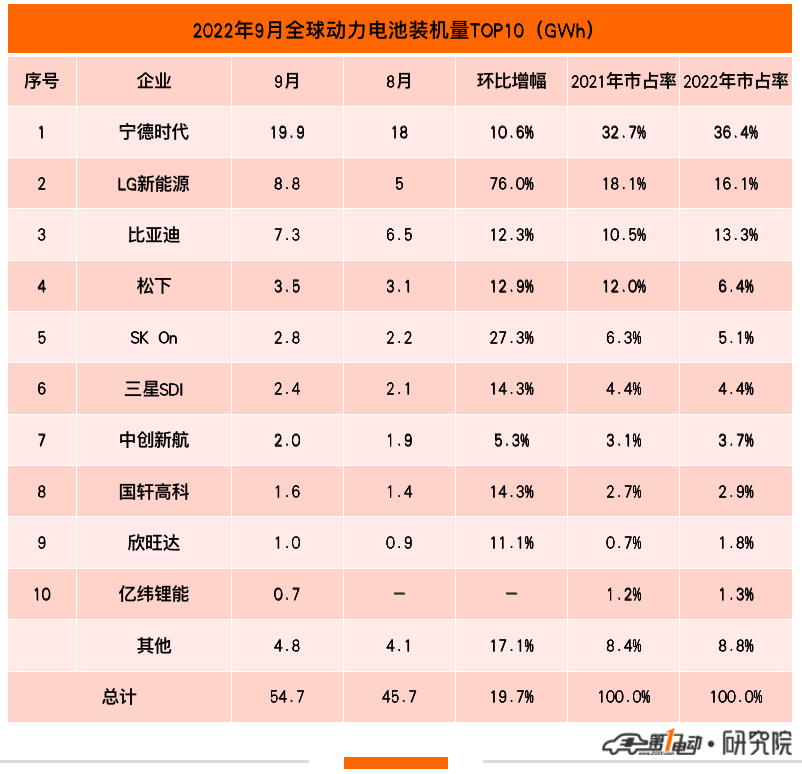

In September, the installed capacity of CATL approached 20GWh, far ahead of the market, but its market share fell again. This is the third decline after the decline in April and July this year. Thanks to the strong sales of Tesla Model 3/Y, Volkswagen ID.4 and Ford Mustang Mach-E, LG New Energy successfully overtook BYD and regained the second place on the list. BYD’s market share fell by 0.9 percentage points, falling to the third place.

In addition to the changes in the second and third positions, another change in the global power battery TOP10 ranking in September is that Yiwei Lithium Energy once again surpassed Honeycomb Energy and ranked 10th on the list.

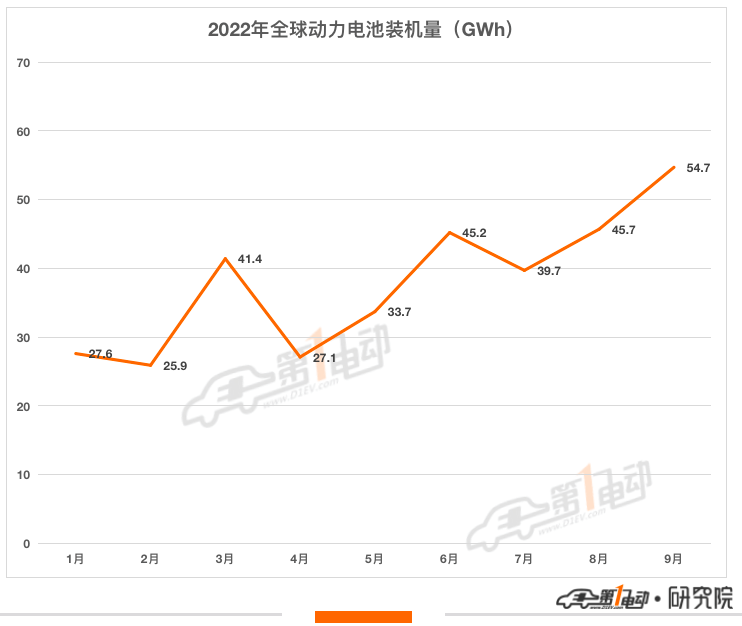

According to data from SNE Research, a South Korean market research institution, the global installed capacity of power batteries in September was 54.7GWh, a month-on-month increase of 19.7% and a year-on-year increase of more than 1.6 times. There are still 6 Chinese companies in the TOP10 global power battery installed capacity, with a market share of 59.4%, a decrease of 4.6 percentage points month-on-month compared with 64% in July, still occupying half of the global power battery market.

In terms of month-on-month growth, the three companies in South Korea have increased their growth by a large margin. Among them, LG New Energy increased by 76% month-on-month, SK On increased by 27.3% month-on-month, and Samsung SDI increased by 14.3% month-on-month. Chinese companies such as CATL, BYD, Guoxuan Hi-Tech, and Xinwangda all increased by more than 10% month-on-month.

In terms of market share, compared with August, except for LG New Energy (up 5.1 percentage points) and SK On (0.3 percentage points), the market shares of other companies have decreased to varying degrees. Among them, CATL market share fell by 3 percentage points, and BYD fell by 0.9 percentage points.

Compared with the same period last year, the market share of CATL increased by 3.7 percentage points, BYD increased by 2.8 percentage points, and Sunwoda increased by 1.1 percentage points. Panasonic’s market share fell 5.6 percentage points, LG New Energy dropped 2 percentage points, and SK On dropped 1.2 percentage points.

In September, the installed capacity of CATL was 19.9GWh, a month-on-month increase of 10.6%, and it still ranked first, with a market share down 3 percentage points month-on-month. This is the third decline in the market share of CATL after the decline in April and July this year. At the market news level, CATL is accelerating its deployment in overseas markets. It will provide lithium iron phosphate batteries for the Ford Mustang Mach-E sold in the North American market from next year, and will provide lithium iron phosphate for the F-150 Lightning pure electric pickup in early 2024. Battery.

After surpassing LG New Energy in April, May, July and August and ranking second, BYD was overtaken by LG New Energy again in September with a disadvantage of 1.5 GWh, and the ranking dropped to third. Since the beginning of this year, the sales of BYD’s new energy vehicles have grown by leaps and bounds. The sales in September exceeded 200,000 in one fell swoop. Correspondingly, the installed capacity of its power batteries has also continued to rise. But because LG New Energy’s layout is a global market, most of BYD’s market is still in China.

Thanks to the hot sale of BYD’s DM-i models, foreign car companies have also begun to favor DM-i hybrid technology. For example, FAW-Volkswagen Audi is going to use BYD DM-i/DM-p hybrid system to install it on its own mainstream models. The first model to be installed may be the Audi A4L.

You must know that although domestic cars have been equipped with BYD DM-i hybrid system before, such as Skyworth, Dongfeng Xiaokang, etc., compared with this, the recognition of FAW-Volkswagen Audi is of great significance to BYD.

The installed capacity of China Innovation Airlines was 2.0GWh, up 5.3% month-on-month, and its market share decreased by 0.5 percentage points month-on-month, up 0.6 percentage points year-on-year, ranking seventh. In addition to the layout of the domestic market, China Innovation Airlines has also accelerated the layout of overseas markets. Not long ago, China Innovation Airlines and the Portuguese government signed a memorandum of cooperation in Sines, Sebatur District, marking the establishment of China Innovation Airlines’ European industrial base. Portugal.

Guoxuan Hi-Tech, which ranked eighth, had an installed capacity of 1.6GWh, up 14.3% month-on-month. At present, Guoxuan Hi-Tech has obtained the official mass production point of Volkswagen’s standard batteries, in the form of square lithium iron phosphate and ternary. The related products will be used in the customer’s largest new energy platform, supporting Volkswagen’s next-generation mass-produced new energy models. It is expected to be loaded in the first half of 2024.

Sunwoda’s installed capacity was 1GWh, up 11.1% month-on-month. With the support of car companies such as Xiaopeng Motors, Li Auto and NIO, Xinwangda has grown rapidly and has become a resident “player” in the list, ranking ninth on the list for six consecutive months. Sunwoda has recently received a fixed-point order from the Volkswagen Group for the battery pack system of the HEV project, which shows that Sunwoda has entered an important milestone in developing global auto brand customers, and is also conducive to enhancing Sunwoda’s presence in the field of electric vehicle batteries. comprehensive competitive strength.

At the same time, on September 1, Sunwang’s issuance of overseas global depositary receipts (GDRs) and its listing on the SIX Swiss Exchange were approved by the China Securities Regulatory Commission.

In September, the installed capacity of Korean companies increased significantly. Among them, thanks to the strong sales of Tesla Model 3/Y, Volkswagen ID.4 and Ford Mustang Mach-E, LG New Energy successfully overtook BYD and regained the second place on the list. However, the year-on-year increase of LG’s new energy installed capacity was only 39.2%, far below the market average, and its market share also lost 2.6 percentage points.

With the launch of the Ioniq 6, SK On’s growth momentum will further expand, thanks to the hot sales of models such as the Hyundai Ioniq 5 and Kia EV6. Driven by the sales of Audi e-tron, BMW iX, BMW i4, FIAT 500 and other models, Samsung SDI installed capacity further increased.

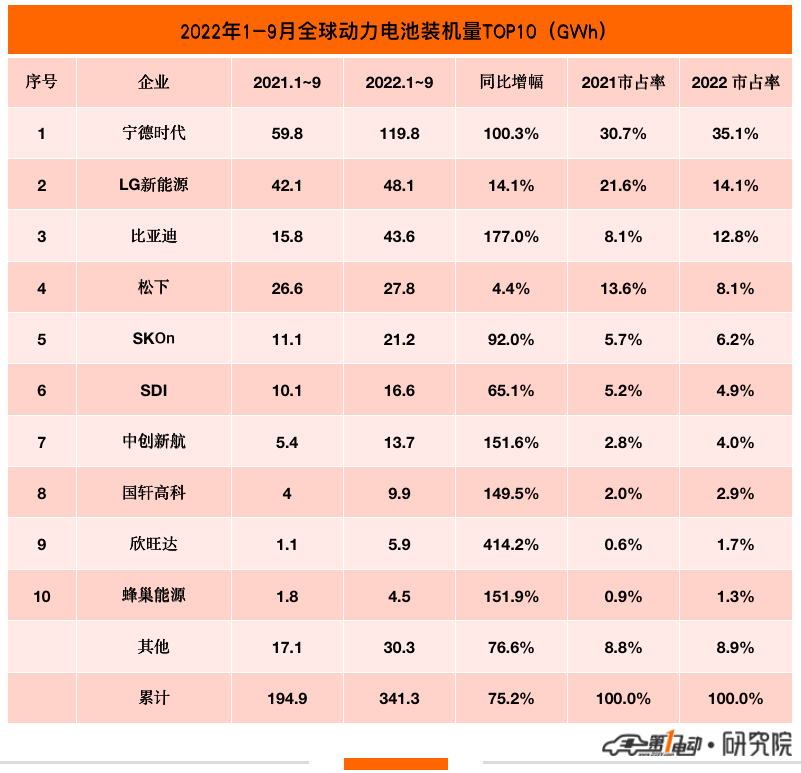

From January to September, the global installed capacity of power batteries was 341.3GWh, a year-on-year increase of 75.2%, continuing the growth trend since the third quarter of 2020. Among them, the installed capacity of CATL reached 119.8 GWh, a year-on-year increase of 100.3%, and its market share also increased from 30.7% to 35.1% . LG’s new energy installed capacity was 48GWh, a year-on-year increase of 14.1%, and its market share decreased by 7.5 percentage points compared with the same period last year. BYD’s installed capacity is 43.6GWh, which is close to LG New Energy, and its market share has increased from 8.1% to 12.8%.

Overall, Chinese car companies still lead the global power battery market in September. Although the global installed capacity of power batteries reached a new high in September, the market share of LG new energy has increased significantly, which has caused the market share of Chinese companies to decline.

In the last three months of 2022, CATL will undoubtedly remain the champion of the global power battery market, and BYD and LG New Energy will compete for the runner-up and third-place positions. We predict that, judging from the current position of BYD’s global new energy vehicle sales, it is highly likely to be the runner-up.

Post time: Nov-08-2022