Since the detailed data will come out later, here is an inventory of the Chinese auto market (passenger cars) in 2022 based on the weekly terminal insurance data. I am also making a pre-emptive version.

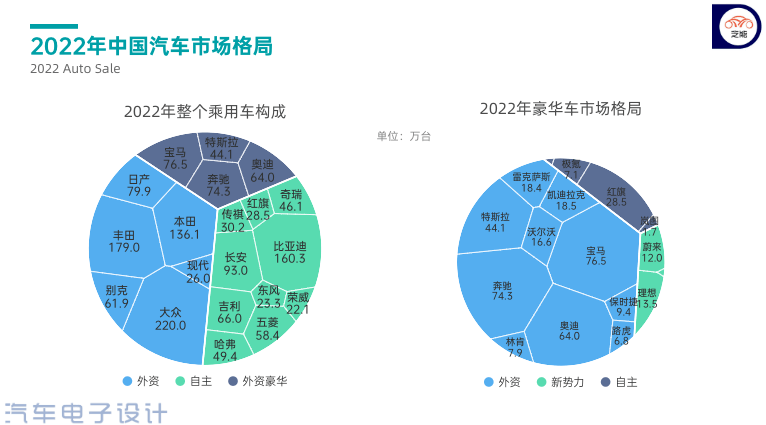

In terms of brands, Volkswagen ranks first (2.2 million) , Toyota ranks second (1.79 million) , BYD ranks third (1.603 million) , Honda ranks fourth (1.36 million) , and Changan ranks fifth (0.93 million) . From the perspective of growth rate, Volkswagen has slightly decreased, Toyota has increased slightly, and BYD has added some historical fuel vehicles with a growth rate of 123%.

The Matthew effect in the auto market exists objectively. We have found that it is becoming more and more difficult for small-scale auto companies to survive. In 2022, there will be 5.23 million terminal passenger cars, with a total of 20.21 million large plates, and a penetration rate of about 25.88%. Looking at the next three years, if the demand of the entire market does not increase rapidly by 2025, the penetration rate will indeed increase further, but there is also the actual difficulty of slowing down the growth rate.

▲Figure 1. Passenger car data terminals in China in 2022

This wave of new energy vehicles and stock models is critical for auto companies to switch tracks. Whether to switch from the original fuel vehicles to new energy vehicles, and to switch from low-end to better tracks is critical. As for foreign-funded enterprises, the TOP20 luxury brands are not brands with strong competitiveness, and life will not be easy in the next few years. At present, the cheap foreign brands that can survive relatively well are only Volkswagen, Toyota, Honda, Nissan and Buick.

We see that the top 20 brands have a scale of 200,000. Assuming that the domestic demand for new cars of around 20 million remains unchanged, the concentration of the entire brand will become higher and higher in the next three years.

▲Figure 2. Brand structure of the Chinese auto market

Part 1

Thoughts on the development of automobile brands

The more you think about the automotive market, the more you can find that companies build their own product portfolios through technology, and finally gain market share and pricing power. The most fundamental key in this process is to either take the route of scale or the route of brand premium. Some companies rely on cars worth more than 300,000 yuan to make money, and some companies can make money from 100,000 to 200,000 yuan based on scale. Different brand logics have completely different strategies.

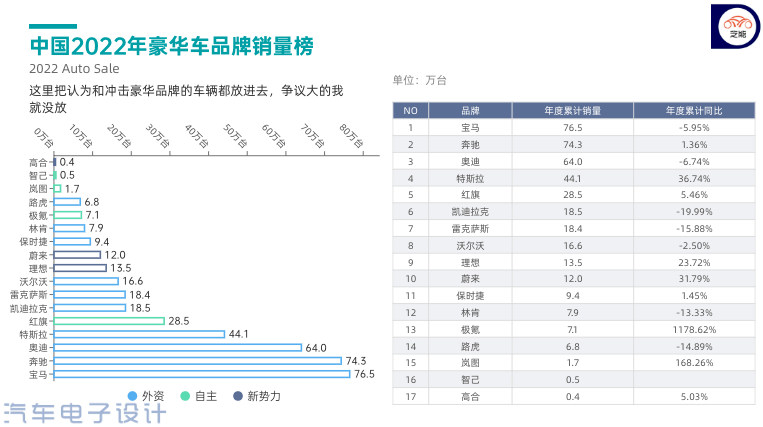

BMW has 765,000 units, Mercedes-Benz has 743,000 units, and Audi has 640,000 units. These top three are particularly stable. Next is Tesla’s 441,000. It is the choice that Tesla needs to make in China to maintain its profit margin compared with BBA or market share. Next is the echelon of 100,000 to 200,000, from Cadillac, Lexus, Volvo, Ideal and Weilai Automobile, Porsche also has a scale of almost 100,000.

Of course, the high price of luxury cars requires a technical foundation and something to support the brand. In this regard, long-term accumulation is required, and it is a matter of course.

▲Figure 3. Market share of luxury brands

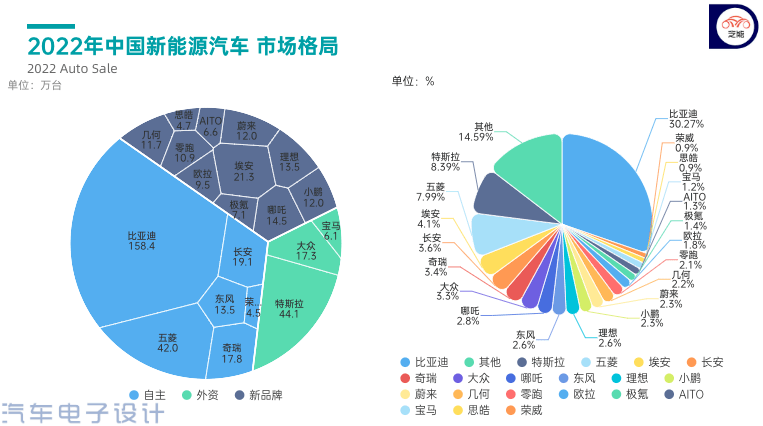

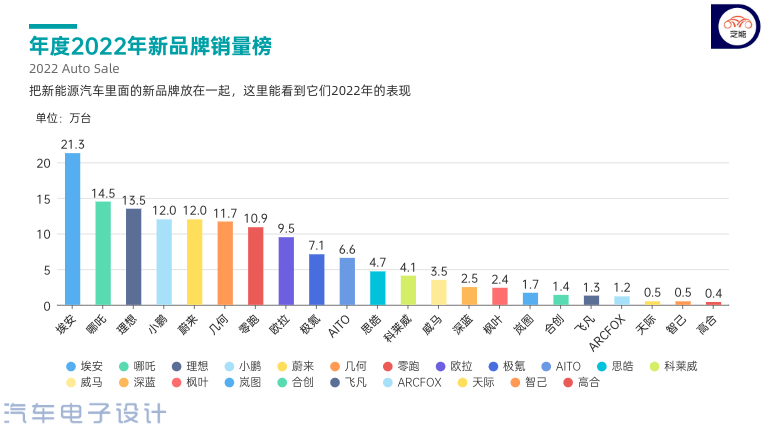

From the perspective of the logic of new energy vehicles, whether this wave is caught or not caught is completely different for the development of enterprises. Interestingly, the last place in the TOP20 is Roewe. The concentration of new energy vehicles is much higher than we imagined. The core problem is that it is not easy to make money.

▲ Figure 4. The situation of new energy vehicles in 2022

In the entire 5.23 million new energy vehicle market, BYD’s market share has reached 30%, which is much higher than the 10.8% market share of the Volkswagen brand in the entire passenger car market.

▲ Figure 5. Concentration of new energy vehicles

I think whether this wave of pure electric vehicles or has grasped this trend-the rise in oil prices and the verification of product reliability in the past few years have led to rapid changes in consumption habits. Opportunities are always reserved for preparation.

▲ Figure 6. Operation of new energy vehicle brands

Part 2

Tesla and BYD

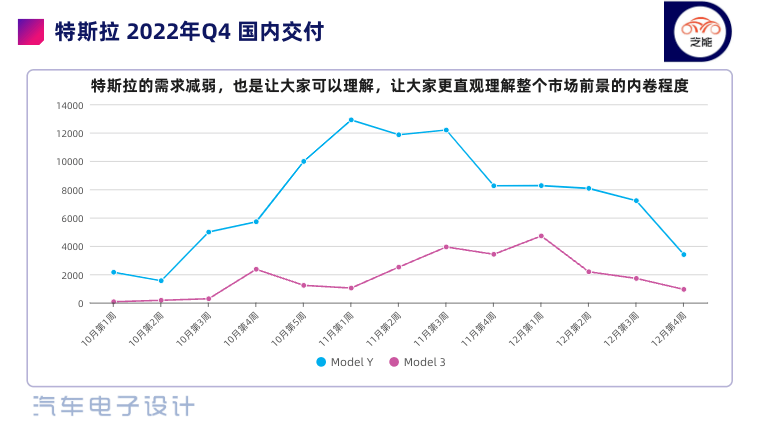

Judging from Tesla’s data, the rapid decline in December caught us by surprise. The momentum of Model Y is due to both the price reduction factor and the early order pool. We have indeed observed consumers’ more rational choices from Tesla. Everyone began to buy Tesla and gradually stopped buying it.

Remarks: I received the news of Tesla’s price cuts for all series early this morning, and Tesla’s response to market data is still very fast.

▲ Figure 7. Tesla’s sudden sluggishness in the fourth quarter

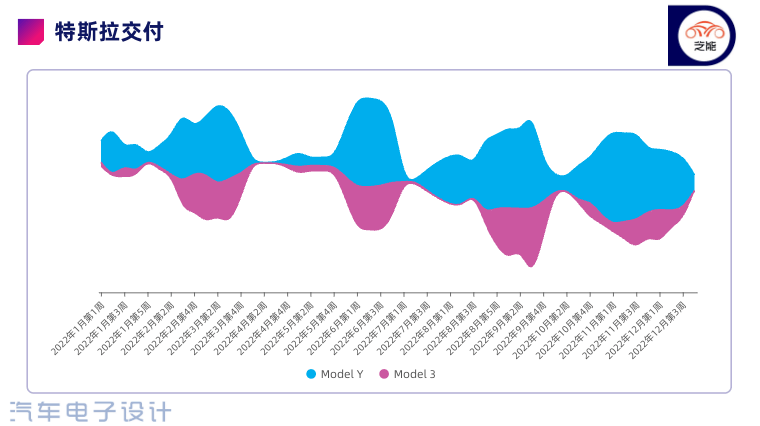

Looking at the entire data with this river graph, it is very clear. Taking away the demand for exports, the situation of the entire Tesla in Q4 does make us a little more rational about the prospects for 2023.

▲ Figure 8. Tesla’s complete weekly delivery review in 2022

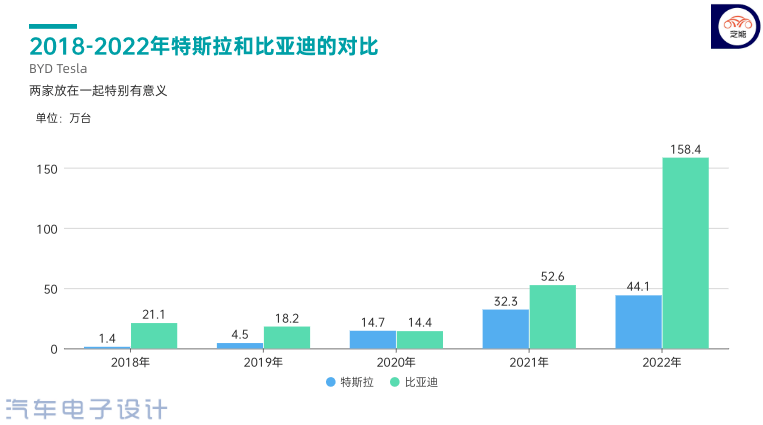

Regarding the gap between Tesla and BYD, I will spend time making a video to think about and discuss the changes in the entire market environment. Personally, I think the biggest difference is the difference in the product matrix of the two.

If it is said that Tesla’s pure electric vehicles will be supported by various blessings in 2021, BYD’s strategy in 2022 will bring down the main price of pure electric vehicles, and then use the DM-i series to grab the market for gasoline vehicles, counting on Model 3 and Model It is Tesla’s wrong judgment to grab the market share of gasoline cars (luxury cars) in the current high price range. Let’s talk about this topic in detail.

▲ Figure 9. Differences between Tesla and BYD

Summary: This is a pre-emptive version. Recently, I am trying to think about the changes in the development of the Chinese auto market in the period from 2023 to 2025, and what factors will affect the trend. It takes a lot of effort to think clearly.

Post time: Jan-07-2023