Recently, Yanyan and I have made a series of in-depth monthly reports (planned to be released in November, mainly to summarize the information in October) , mainly covering four parts:

● Charging facilities

Pay attention to the situation of charging facilities in China, the self-built networks of power grids, operators and car companies.

● Battery exchange facility

Pay attention to the situation of China’s new wave of battery replacement facilities, NIO, SAIC and CATL

● Global dynamics

Pay attention to changes in global charging facilities, mainly including cooperation between auto companies and energy vehicles in the United States, Europe, and Southeast Asia, as well as regulations and standards

● Industry dynamics

As the industry enters the phase-out period, pay attention to the relatively in-depth information such as the analysis of corporate cooperation & mergers and acquisitions in the current industry, technological changes, and costs .

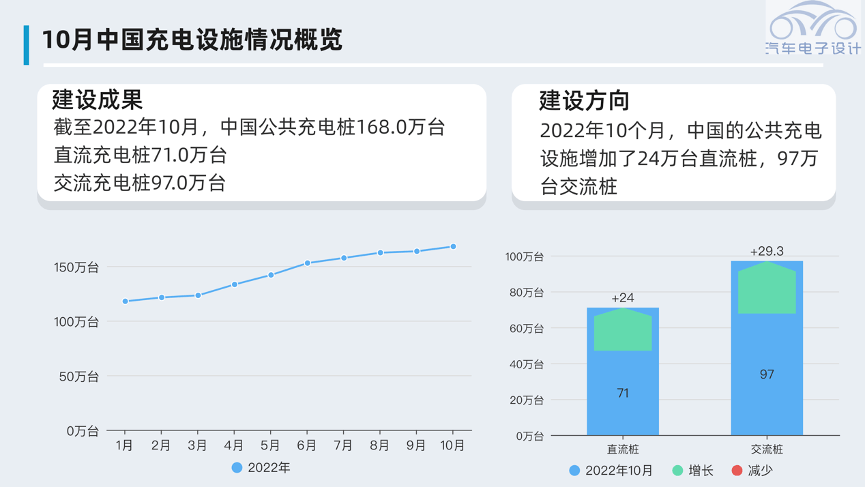

As of October 2022, China’s public charging piles will have 1.68 million DC charging piles, 710,000 AC charging piles, and 970,000 AC charging piles. From the perspective of the overall construction direction, in October 2022, China’s public charging facilities have added 240,000 DC piles and 970,000 AC piles.

▲ Figure 1. Overview of charging facilities in China

Part 1

Overview of China’s charging facilities in November

If new energy vehicles want to achieve a good experience, public charging facilities are essential. At present, China’s charging facilities have resonated with consumers’ purchases, that is, local governments and operators are planning to deploy in places with a lot of cars. Therefore, if we put the penetration rate of new energy vehicles and the retention rate of charging piles together, they basically coincide.

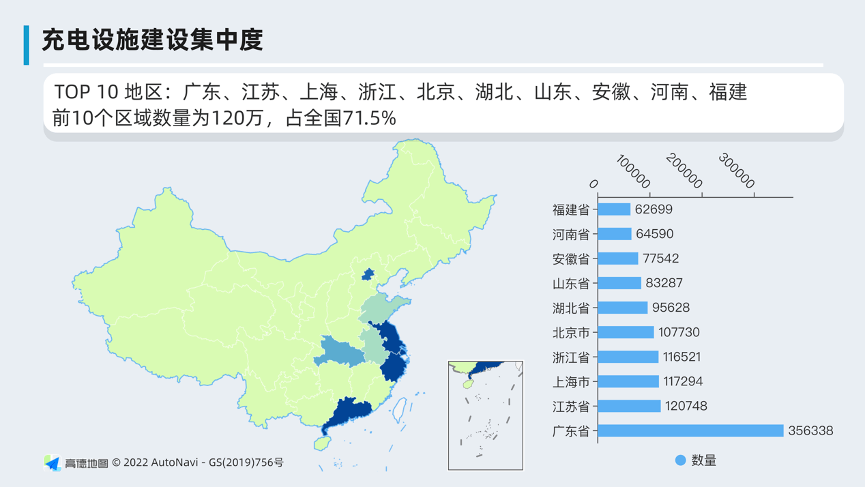

At present, TOP 10 regions: Guangdong, Jiangsu, Shanghai, Zhejiang, Beijing, Hubei, Shandong, Anhui, Henan, and Fujian. A total of 1.2 million public charging piles have been built in these regions, accounting for 71.5% of the country.

▲Figure 2. Concentration of charging facilities

The number of new energy vehicles in China has rapidly increased to about 12 million, the total number of charging facilities is 4.708 million, and the vehicle-to-pile ratio is currently about 2.5. From a historical perspective, this number is indeed improving. But we have also seen that this wave of growth is still that the growth rate of private piles is much higher than that of public piles.

If you count public piles, there are only 1.68 million, and if you subdivide DC piles with high utilization rate, there are only 710,000. This number is the largest in the world, but it is still less than the total number of new energy vehicles.

▲Figure 3. Vehicle-to-pile ratio and public charging piles

▲Figure 3. Vehicle-to-pile ratio and public charging piles

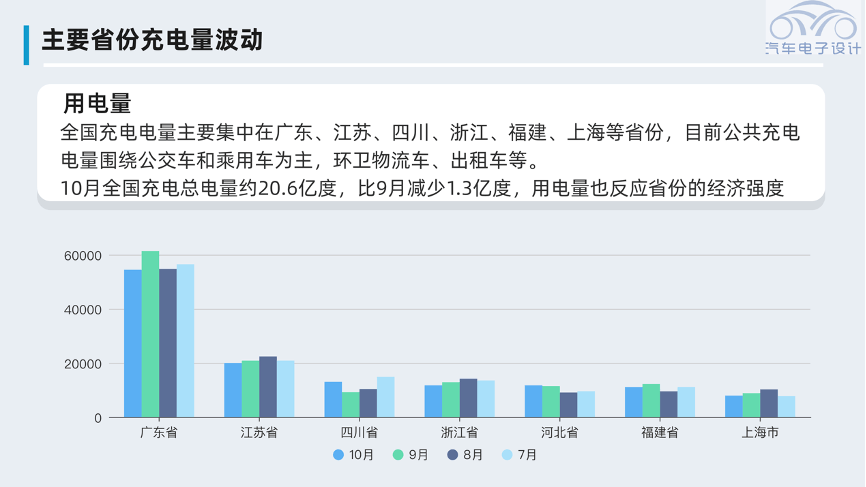

Since the number of new energy vehicles is also very concentrated, the national charging power is mainly concentrated in Guangdong, Jiangsu, Sichuan, Zhejiang, Fujian, Shanghai and other provinces. At present, the public charging power is mainly around buses and passenger cars, sanitation logistics vehicles, Taxi etc. In October, the total charging electricity in the country was about 2.06 billion kWh, which was 130 million kWh less than that in September. The power consumption also reflects the economic strength of the province.

From my understanding, the construction of charging piles has also been affected recently, and the whole car and piles are a linkage effect.

▲Figure 4. Charging capacity of each province in the country

▲Figure 4. Charging capacity of each province in the country

Part 2

Carriers and car companies

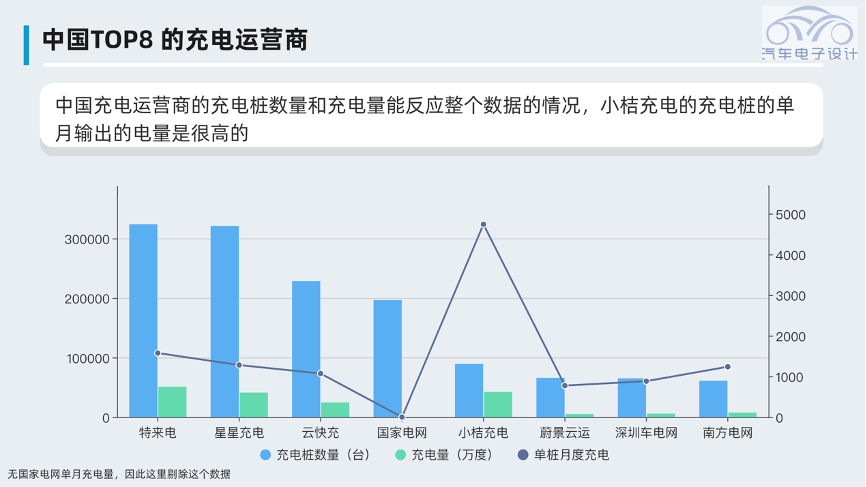

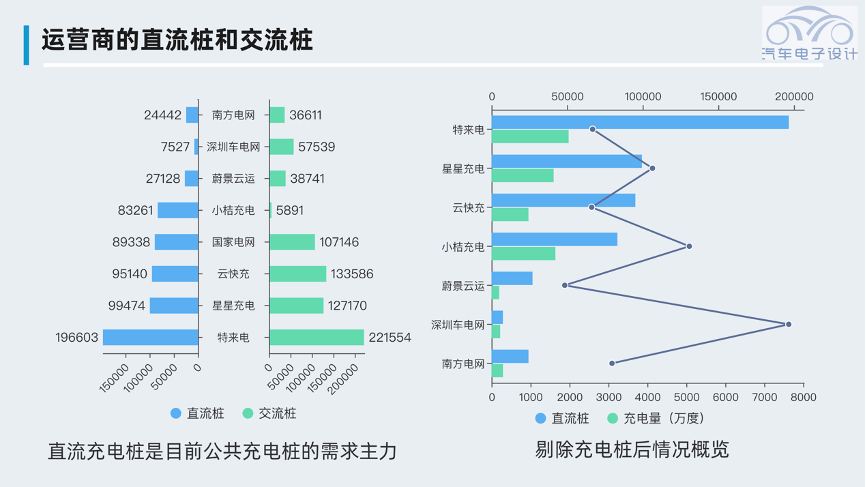

No matter how many piles the operator has reported, if it is directly linked to the charging capacity, this data is very valuable. The number of charging piles and charging capacity of Chinese charging operators can reflect the overall data. The monthly output of the charging piles charged by Xiaoju is very high.

▲Figure 5. The total number of charging piles of charging operators

▲Figure 5. The total number of charging piles of charging operators

If the AC piles are removed, it will be more intuitive to reflect the operation of each charging operator. Considering the waiting time and parking conditions, we need to pay more attention to the comparison of subsequent DC piles, which is of direct significance to ordinary users.

▲Figure 6. AC piles and DC piles of charging operators

▲Figure 6. AC piles and DC piles of charging operators

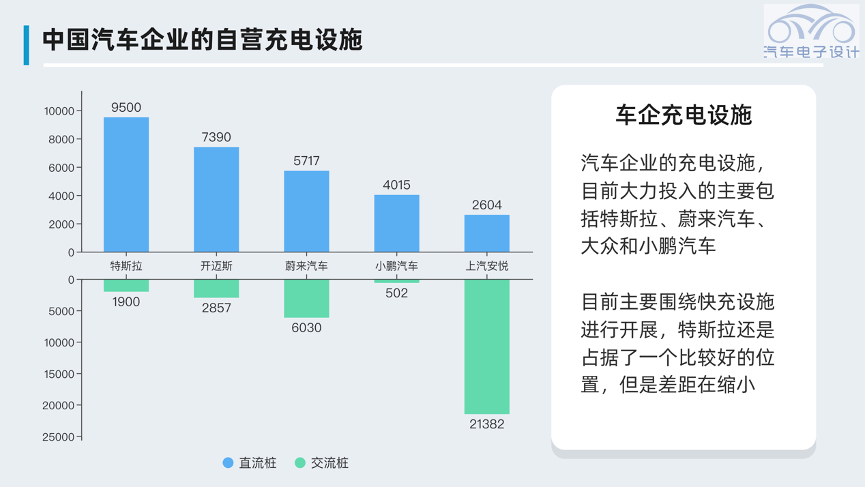

From the perspective of the layout of various enterprises, it is impossible to achieve good results simply by connecting to the charging piles of operators. At present, the charging facilities of automobile companies mainly include Tesla, Weilai Automobile, Volkswagen and Xiaopeng Automobile. At present, they mainly focus on fast charging facilities. Tesla still occupies a relatively good position, but the gap is zoom out.

▲Figure 7. The layout of charging facilities of Chinese auto companies

▲Figure 7. The layout of charging facilities of Chinese auto companies

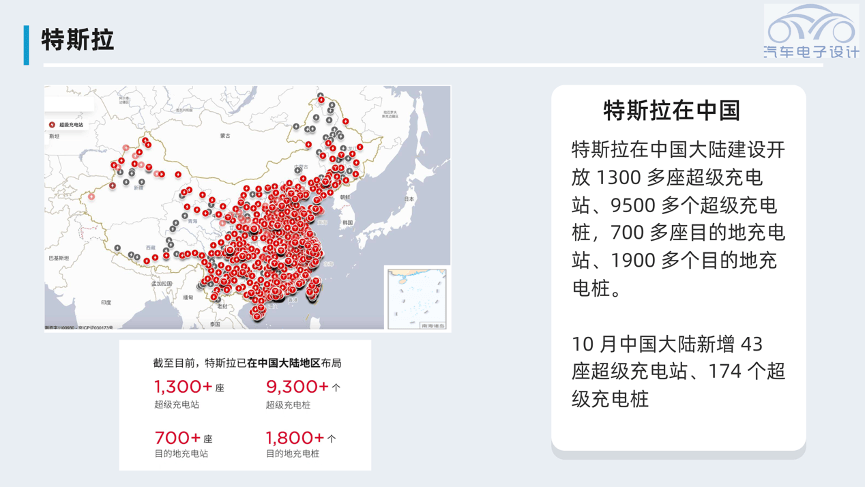

Tesla has an advantage in China, but it is currently shrinking. Even if it builds its own supercharger assembly plant, the grid capacity will limit the layout in the end. At present, Tesla has built and opened more than 1,300 super charging stations, more than 9,500 super charging piles, more than 700 destination charging stations, and more than 1,900 destination charging piles in mainland China. In October, mainland China added 43 super charging stations and 174 super charging piles.

▲Figure 8. The situation of Tesla

▲Figure 8. The situation of Tesla

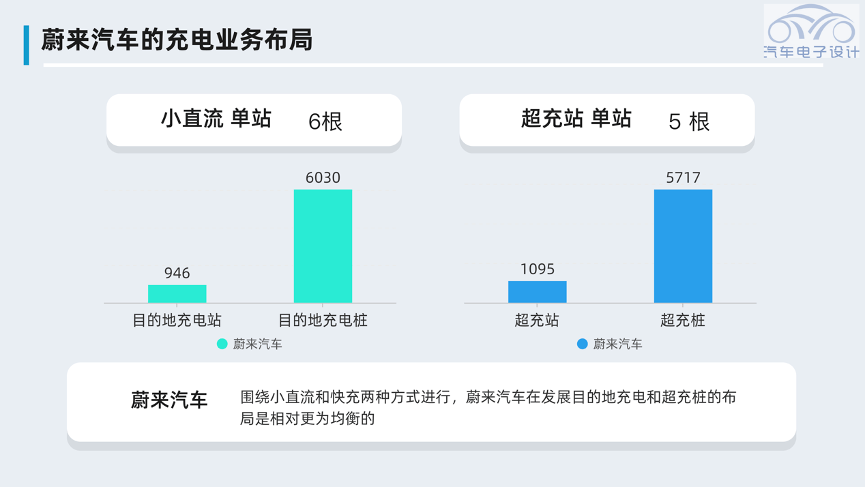

NIO’s charging network is actually a hedging method. With the support of battery replacement technology, it currently mainly serves other brands of cars, but the follow-up second and third brand cars are another development direction. From battery replacement to compatible fast charging, this layout is very critical.

▲Figure 9. NIO’s charging network

▲Figure 9. NIO’s charging network

The challenge for Xiaopeng Motors is to build an 800V ultra-high-power fast charging station by itself, which is extremely difficult. As of October 31, 2022, a total of 1,015 Xiaopeng self-operated stations have been launched, including 809 super charging stations and 206 destination charging stations, covering all prefecture-level administrative regions and municipalities across the country. The layout of S4 ultra-fast charging stations is planned. By the end of 2022, 7 Xpeng S4 ultra-fast charging stations will be launched simultaneously in 5 cities including Beijing, Shanghai, Shenzhen, Guangzhou, and Wuhan, and the first batch of S4 ultra-fast charging stations in 5 cities and 7 stations will be completed.

▲Figure 10. The charging network of Xpeng Motors

▲Figure 10. The charging network of Xpeng Motors

CAMS has deployed 953 super charging stations and 8,466 charging terminals in 140 cities across the country, fully covering 8 core cities such as Beijing and Chengdu, realizing the convenience of charging within 5 kilometers of the main urban area.

Post time: Nov-29-2022