Oil prices are up ! The global auto industry is undergoing all-round upheaval. Tighter emissions regulations, coupled with higher average fuel economy requirements for businesses, have exacerbated this challenge, leading to an increase in both demand and supply of electric vehicles. According to the forecast of the Supply Chain and Technology Department of IHS Markit, the output of the global new energy vehicle motor market will exceed 10 million in 2020, and the output is expected to exceed 90 million in 2032, with a compound annual growth rate (CAGR) of 17% .

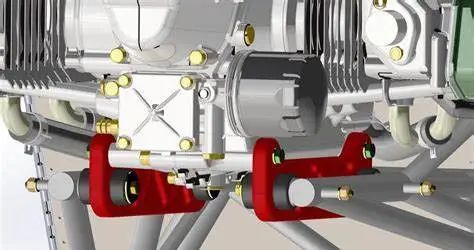

engine-mounted motor

Unlike other types of motors, in the transmission-connected motor market, Japan and South Korea alone accounted for about 50% of the production in 2020. At this proportion, considering the focus on full hybrid and plug-in hybrid vehicles in these countries, this data is not difficult to understand. In addition, leading OEMs using transmission-connected motors in electrified vehicle production and their key suppliers are also located in Japan and South Korea.

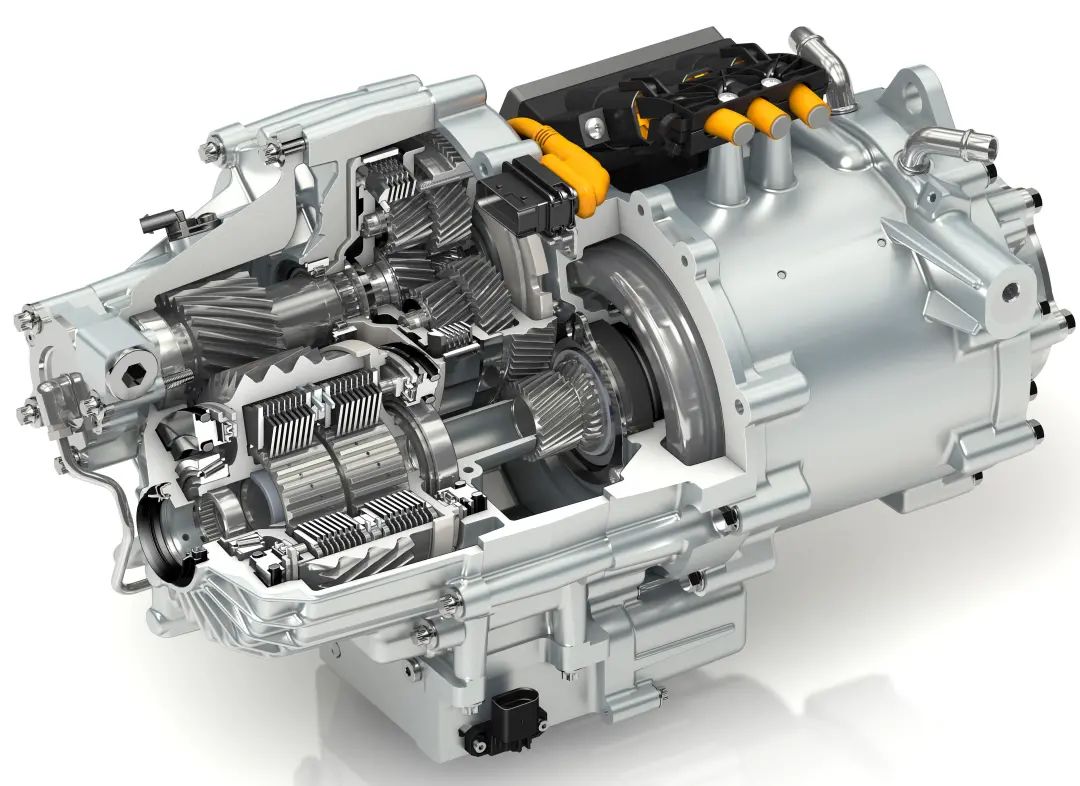

e-axle motor

According to the forecast of IHS Markit Supply Chain and Technology Department, by 2020, e-axle motors will account for about 25% of the propulsion motor market, and it is expected that the compound annual growth rate of this market will reach 20.1% by 2032, which is the fastest growing among all propulsion motors. Fastest category. This is a significant market opportunity for all areas of the motor supply chain, such as electrical steel producers, copper winding producers and aluminium caster producers. In the e-axle motor market, both Europe and Greater China lead the pack and are expected to account for over 60% of global production during the 2020-26 forecast period.

In-wheel motor

The fourth type of motor is the hub motor, which allows the motor to be placed in the center of the wheel, reducing the components needed to reduce transmission and energy losses associated with gears, bearings and universal joints.

In-wheel motors are classified as P5 architectures and appear to be an attractive alternative to conventional powertrains, but they have significant drawbacks. In addition to the cost increase brought about by technological progress, the problem of increasing the unsprung weight of the vehicle has been detrimental to the popularity of in-wheel motors. In-wheel motors will remain a segment of the global light-duty vehicle market, with annual sales remaining below 100,000 for most of the next decade, IHS Markit said.

Homemade or Outsourced Strategies

As the vanguard of the promotion of new energy vehicles in the city, the application of charging infrastructure in Shanghai is a microcosm of the development of new energy vehicles.

Wang Zidong pointed out that battery swapping and charging are not completely opposites. This is a new option with considerable social benefits. “When the life of the battery pack is increased and the safety is improved, the passenger cars in the battery swap mode will be widely used in the market. At that time, not only the B-end cars, but also the C-end cars (private cars) will gradually catch up with this. need.”

Huang Chunhua believes that in the future, new energy vehicle users have time to charge, but no time to replace the battery. They can also upgrade the battery by replacing the power station, so that users have a variety of choices, and more convenient ways of use are the focus of industrial development. In addition, the Ministry of Industry and Information Technology recently notified that in 2022, a city pilot program for the full electrification of vehicles in the public sector will be launched. Behind this must be the combination of charging and battery swapping to promote the full electrification of vehicles in the public sector. “In the next two to three years, in sub-sectors such as public transportation and transportation, the popularity of battery swapping will accelerate.”

Post time: Jul-07-2022