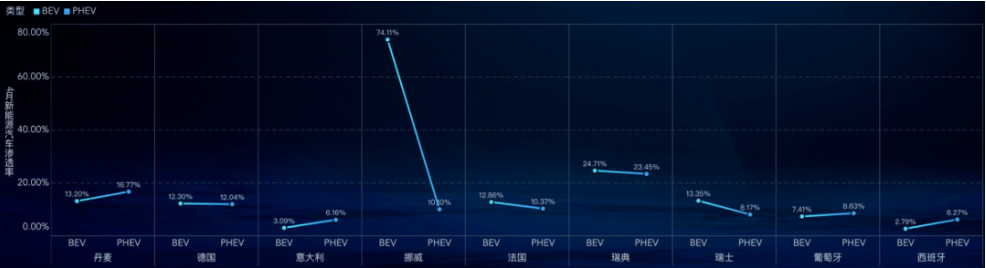

Globally, overall vehicle sales were down in April, a trend that was worse than LMC Consulting’s forecast in March. Global passenger car sales fell to 75 million units/year on a seasonally adjusted annualized basis in March, and global light vehicle sales fell 14% year-on-year in March, and the current release looks at:

U.S. fell 18% to 1.256 million vehicles

Japan fell 14.4% to 300,000 vehicles

Germany fell 21.5% to 180,000 vehicles

France fell 22.5% to 108,000

If we estimate the situation in China, according to the estimates of the China Passenger Car Association, the retail sales target of auto companies in April fell sharply year-on-year. The retail sales of passenger vehicles in the narrow sense are expected to be 1.1 million units, a year-on-year decrease of 31.9%. According to this calculation, the entire global Passenger cars will drop by around 24% in April 2022.

▲Figure 1. Overview of global passenger car sales, the auto industry is in a weak cycle

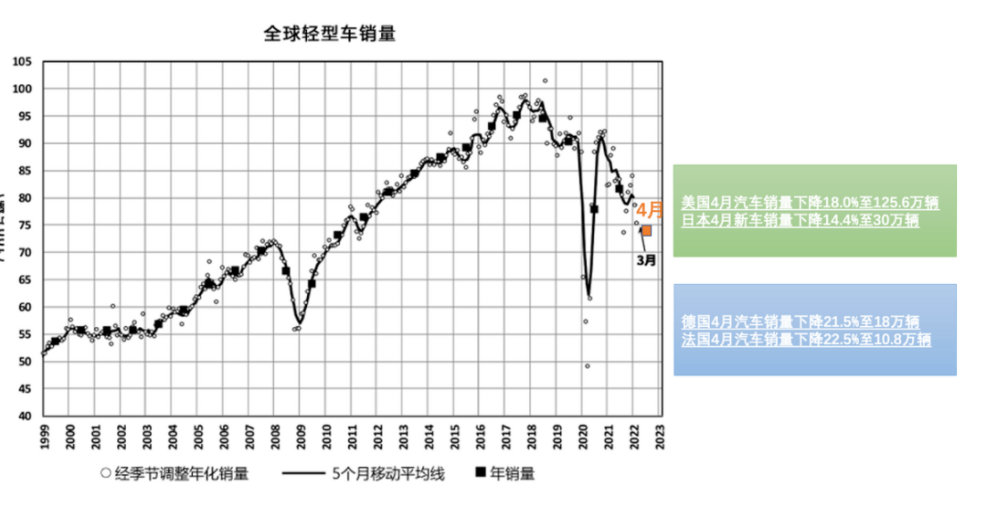

From the perspective of the entire new energy vehicle:

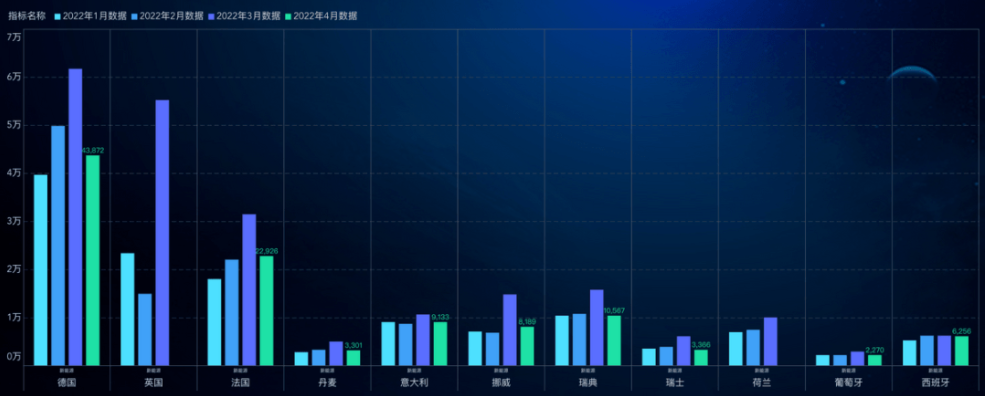

The sales volume in April was 43,872 units, a year-on-year decrease of -14% and a month-on-month decrease of -29%; the April sales of 22,926 units increased by 10% year-on-year and decreased by 27% month-on-month. The data from the UK has not yet come out. The situation of new energy vehicles in April was basically sideways, and the growth situation was not very good.

▲Figure 2. Sales of new energy vehicles in Europe

Part 1

Year-on-year data overview

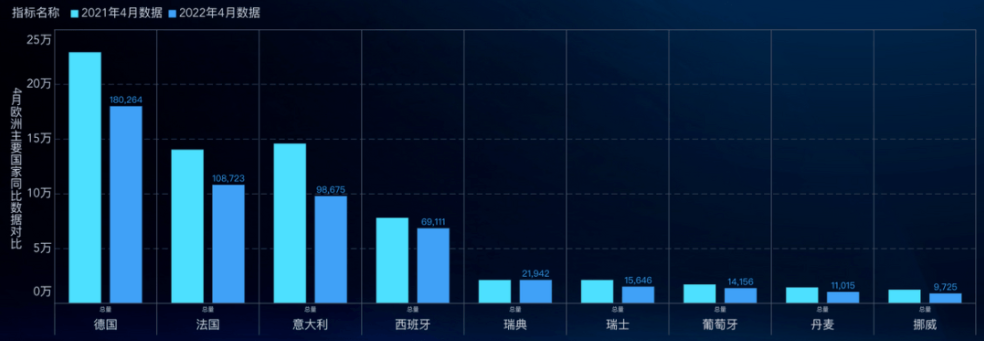

From the perspective of Europe, the main markets of Germany, France, Italy and Spain are all declining, and there is a high probability that car sales in the UK will also decline. The correlation between car consumption and the macroeconomic environment is too great.

▲Figure 3. Comparison of the total in April 2022, European car consumption is weakening

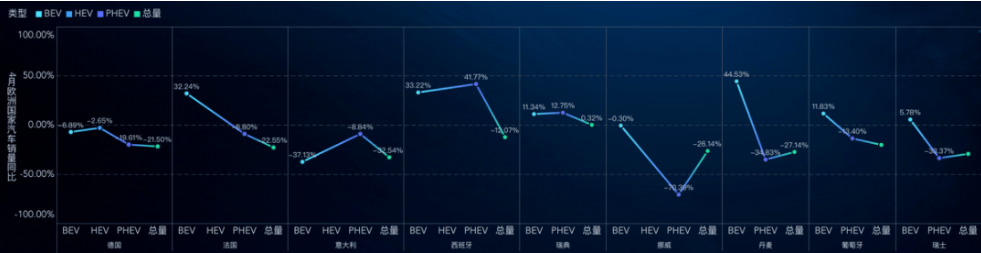

If you break down the total amount, HEV, PHEV and BEV, the decline not particularly obvious, and the decline of PHEV is quite large due to supply.

▲Figure 4. Year-on-year data by type in April 2022

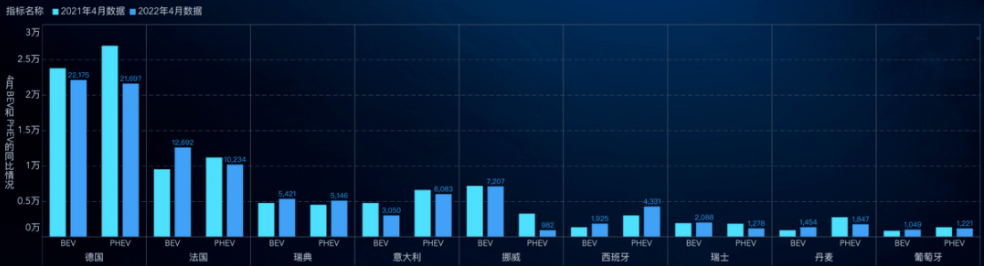

In Germany, 22,175 pure electric vehicles (-7% year-on-year, -36% month-on-month), 21,697 plug-in hybrid vehicles (-20% year-on-year, -20% month-on-month), the total penetration rate of new energy vehicles in the month was 24.3%, a year-on-year increase Up 2.2%, a month of low volumes in Germany

In France, 12,692 pure electric vehicles (+32% year-on-year, -36% month-on-month) and 10,234 plug-in hybrid vehicles (-9% year-on-year, -12% month-on-month); the penetration rate of new energy vehicles in the month was 21.1%, a year-on-year increase of 6.3%

Other markets Sweden, Italy, Norway and Spain are generally in a state of low growth.

▲Figure 5. Comparison of BEV and PHEV in April 2022

In terms of penetration rate, in addition to Norway, which has achieved a high penetration rate of 74.1% of pure electric vehicles; several large markets have a penetration rate of 10% of pure electric vehicles. In the current economic environment, if you want to take a step forward, The price of power batteries is also continuing to rise.

▲Figure 6. The penetration rate of BEV and PHEV

Part 2

The question of supply and demand this year

The problem faced by Europe is that on the supply side, due to the supply of chips and Ukrainian wiring harness companies, insufficient supply of vehicles has led to rising vehicle prices; and the increase in inflation rate has reduced the actual income of the people, superimposed that gasoline prices have soared, and business operating costs have increased The threat of rising potential unemployment, seen here in Germany, where the economy is the strongest, is falling faster than the Fleet fleet in personal car purchases (fleet sales fell 23.4%, private purchases fell 35.9%) %) .

In the latest report, the cost of the automotive industry has begun to shift, and Bosch said that the increase in raw material, semiconductor, energy and logistics costs needs to be borne by customers.

Auto supplier giant Bosch is renegotiating contracts with automakers to increase what it charges them for supplies, a move that could mean car buyers will see yet another boost on window sticker prices during this pandemic.

▲Figure 7. The price transmission mechanism from auto parts to auto companies has begun

Summary: I think the ultimate possibility is that the price of cars will continue to rise for a period of time, and then the demand will be differentiated according to the product strength and the actual situation of the sales terminal; in this process, the scale effect of the automobile industry is weakening, and the scale is determined according to the demand. , and the profit margin of the industrial chain will be compressed for a period of time. It’s a bit like the era of the oil crisis, where you need to find companies that can survive. This period is the clearing stage of the market elimination period.

Source: First Electric Network

Author: Zhu Yulong

Address of this article: https://www.d1ev.com/kol/174290

Post time: May-05-2022