This year, in addition to MG (SAIC) and Xpeng Motors, which were originally sold in Europe , both NIO and BYD have used the European market as a big springboard. The big logic is clear:

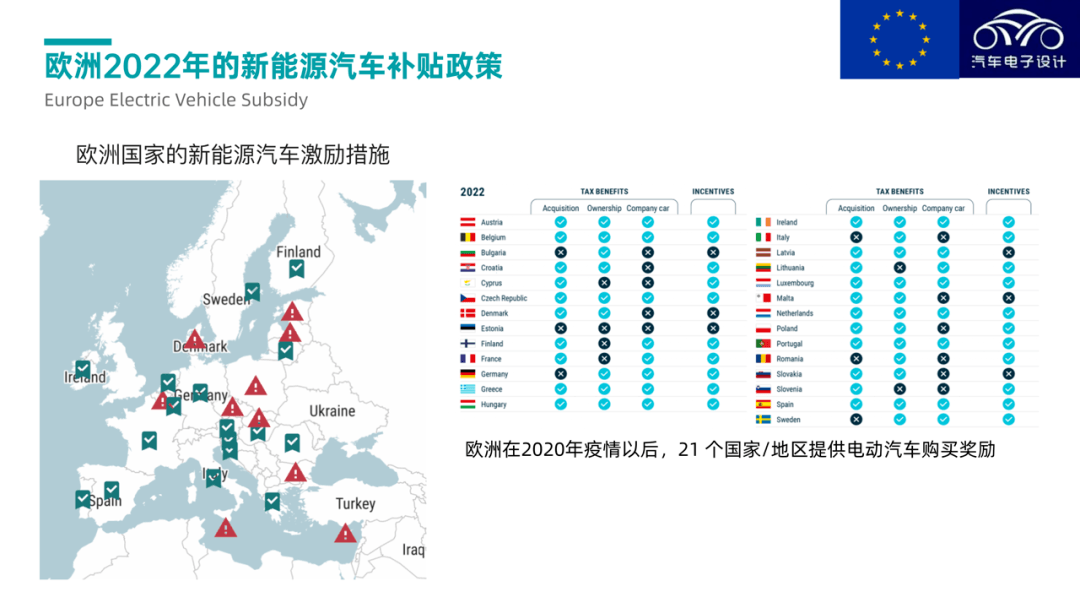

● The major European countries Germany, France, Italy and many Western European countries have subsidies, and the Nordic countries will have tax incentives after the subsidies are over. The same models can be priced higher in Europe than in China, and they can be made in China and exported to Europe at a premium.

● The models promoted by European car companies in China, ranging from BBA to Volkswagen, Toyota, Honda and French cars, have all seen the problem. The iteration is slow, the price is relatively high, and there is a gap between our competitiveness and involution.

▲Figure 1. Sales of auto companies in Europe in 2022

And recently, ACEA President and BMW CEO Oliver Zipse made some remarks on some occasions: “In order to ensure a return to growth and a larger market in electric vehicle sales, Europe urgently needs to establish the right framework conditions, a larger European supply chain. Resilience, the EU Critical Raw Materials Act to ensure strategic access to raw materials needed for electric vehicles, and the accelerated rollout of charging infrastructure. Major events over the past few years, such as Brexit, the coronavirus pandemic, semiconductor supply bottlenecks and the Russian-Ukrainian war, These events have had an impact on prices and energy supply, and the speed, depth and unpredictability with which the world is changing. This applies in particular in a geopolitical context, where industries and their tightly-knit value chains have a direct impact.”

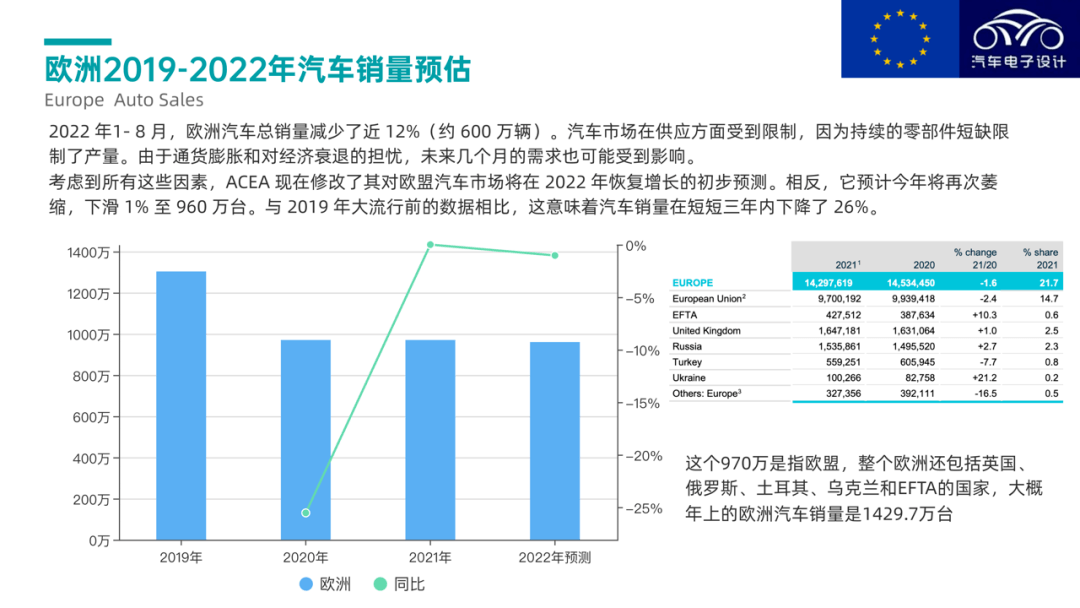

To put it simply, various regulatory restrictions in Europe have a great impact on the development of European auto companies. Coupled with various policies, the European auto industry is in a weak period. ACEA revised its initial forecast that the EU car market will return to growth in 2022, forecasting another contraction this year, down 1% to 9.6 million units. Compared to 2019 figures, car sales fell 26% in just three years.

▲Figure 2. Car sales in Europe

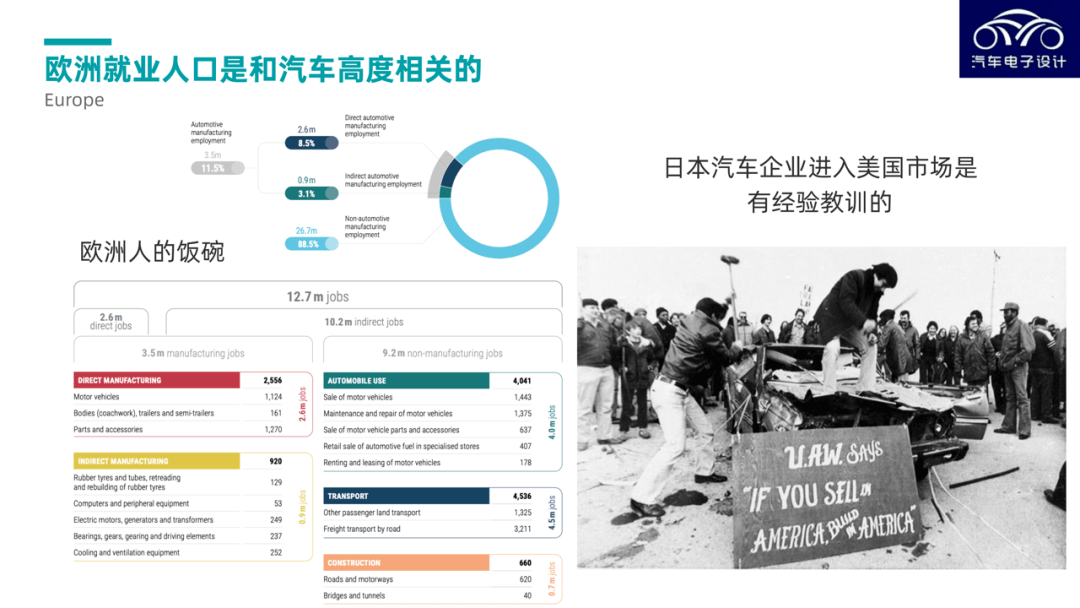

In fact, when Chinese auto companies enter Europe at this time, they don’t know how much money they make in terms of economic benefits, but the geographical challenges will be huge. You earn billions, and the geopolitical issues brought about may require careful evaluation. This is a bit like the situation of Japanese auto companies entering the US market. The thing to note is that the correlation between the employment population and the auto industry in Europe, and the subsequent economic and ZZ problems are of the same origin.

▲Figure 3. Employment issues are directly related to Political in Europe

Part 1

Involution of the automotive industry worldwide

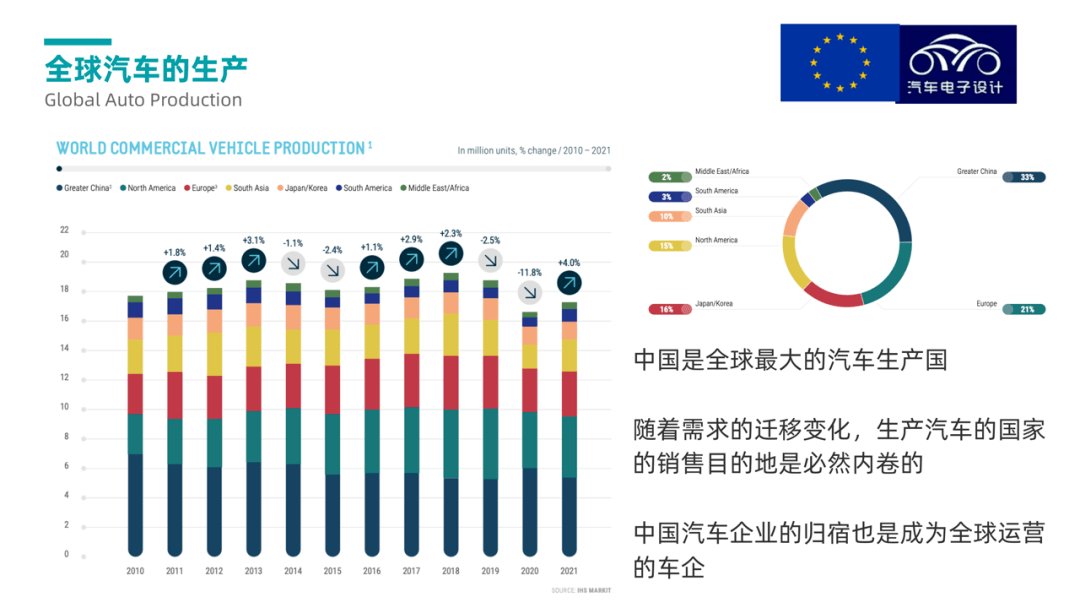

As car-producing countries compete for the market against the backdrop of declining global demand for automobiles, increase capacity utilization. The whole competition from automobile products to market competition is inevitable, and it is relatively easy to compete in the domestic market.

▲Figure 4. The situation of global automobile production

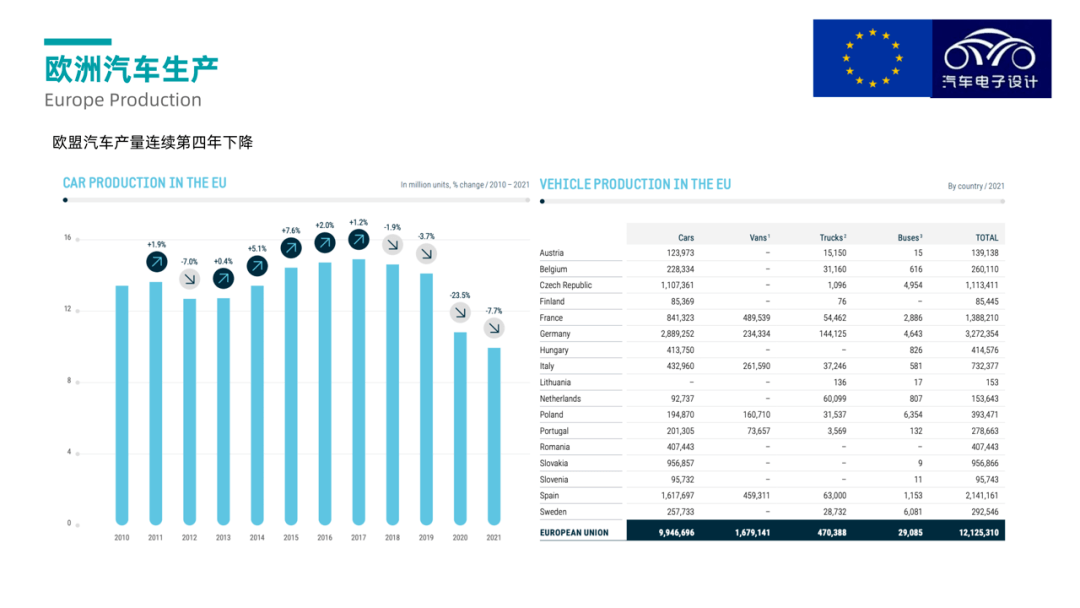

We see a particularly big challenge in Europe, where as you can see below, European car production has declined for 4 years in a row.

▲Figure 5. Overview of European car production

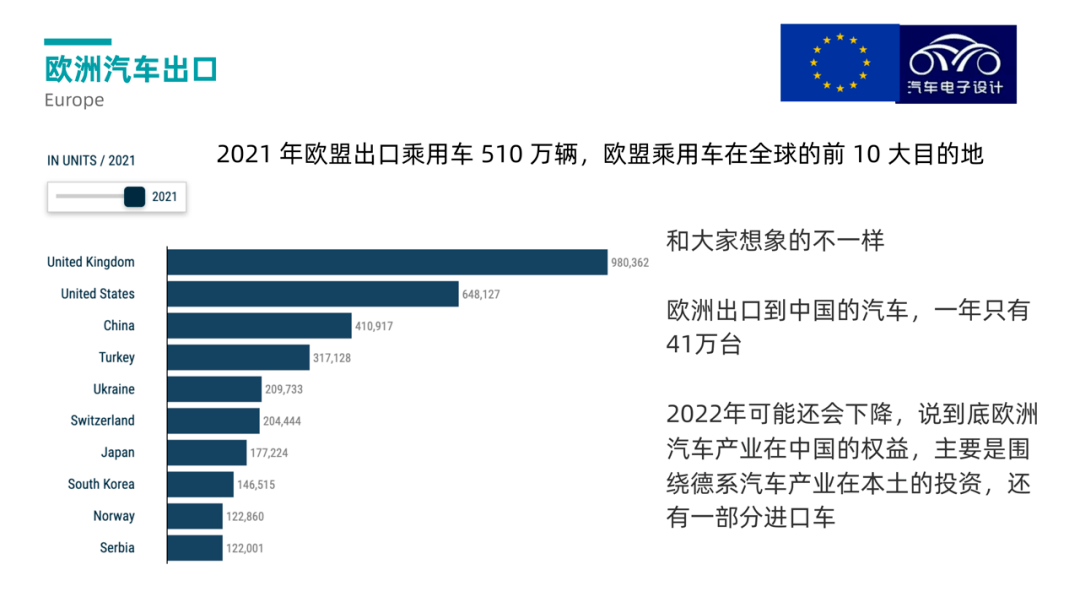

In 2021, the EU will export 5.1 million passenger cars, and the EU passenger cars are in the top 10 global destinations (UK, US, China, Turkey, Ukraine, Switzerland, Japan, South Korea, Norway and Middle East countries) .

Contrary to everyone’s imagination, the number of cars exported from Europe to China is only 410,000 a year. It may decline in 2022. In the final analysis, the rights and interests of the European auto industry in China mainly revolve around the local investment of the German auto industry, as well as some imported cars.

▲Figure 6. Exports of European auto companies

According to IHS data, from January to August 2022, the world’s new energy passenger vehicle sales reached 7.83 million units, and China’s new energy passenger vehicles accounted for 38.6% of the market; Europe was the second largest market, with a market share of 27.2%. Among them, the global sales of pure electric passenger vehicles were 5.05 million units, and China’s pure electric passenger vehicles accounted for 46.2%; Europe was the second largest market in the world, with a market share of 21.8%.

Part 2

Chinese auto companies in Europe

We see that Chinese new energy vehicle companies are still very active in Europe during this period:

● In the second half of the year, BYD announced to cooperate with Hedin Mobility, a leading dealer group in the European industry, to provide high-quality new energy vehicle products for the Swedish and German markets.

● At the beginning of October, NIO held the NIO Berlin 2022 event in Berlin, officially announcing that it will adopt an innovative subscription model to provide full-system services in Germany, the Netherlands, Denmark, and Sweden, and open the ET7, EL7 and ET5 three NIO NT2 platform models. Booking.

In fact, we see Chinese brands MG, Chase including Geely’s Polestar all being sold in Europe. My understanding is that, if you want to occupy the market in Europe, how to enter is very important.

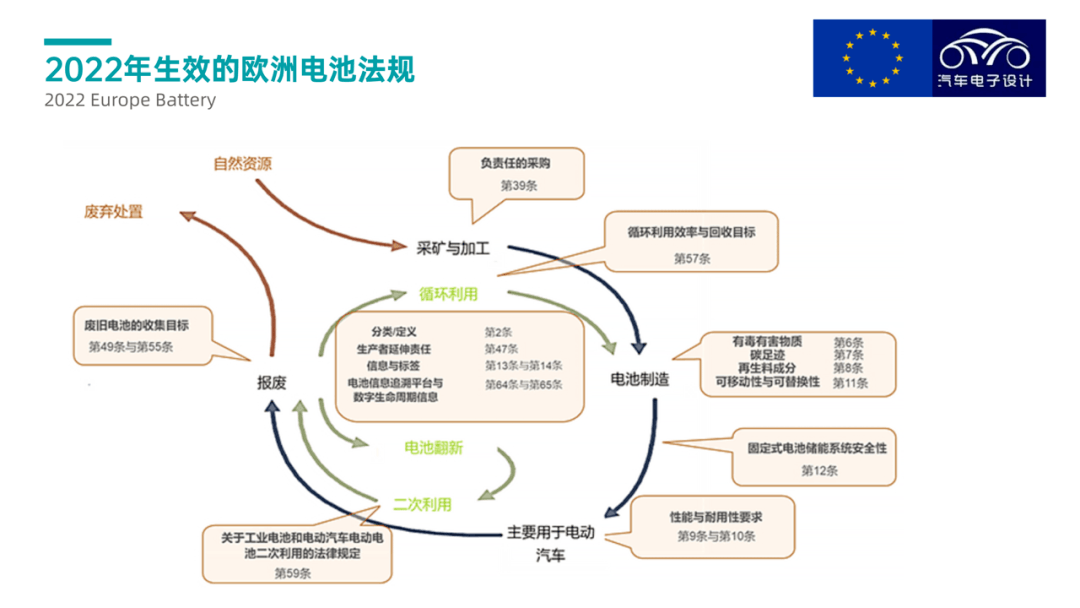

Europe has also promulgated the EU Battery Regulations, which cover all stages of the battery life cycle: from the production and processing of battery raw materials, to the use of battery products, to the recycling of decommissioned and end-of-life batteries. In response to the new requirements put forward in the new regulations, enterprises need to take timely actions in product development, raw material procurement and supply chain management, and formulate and implement medium and long-term response plans. In fact, this battery regulation will bring a lot of challenges to the battery value chain, especially new energy vehicle and power battery manufacturers to enter the EU market.

▲Figure 7. European battery regulations

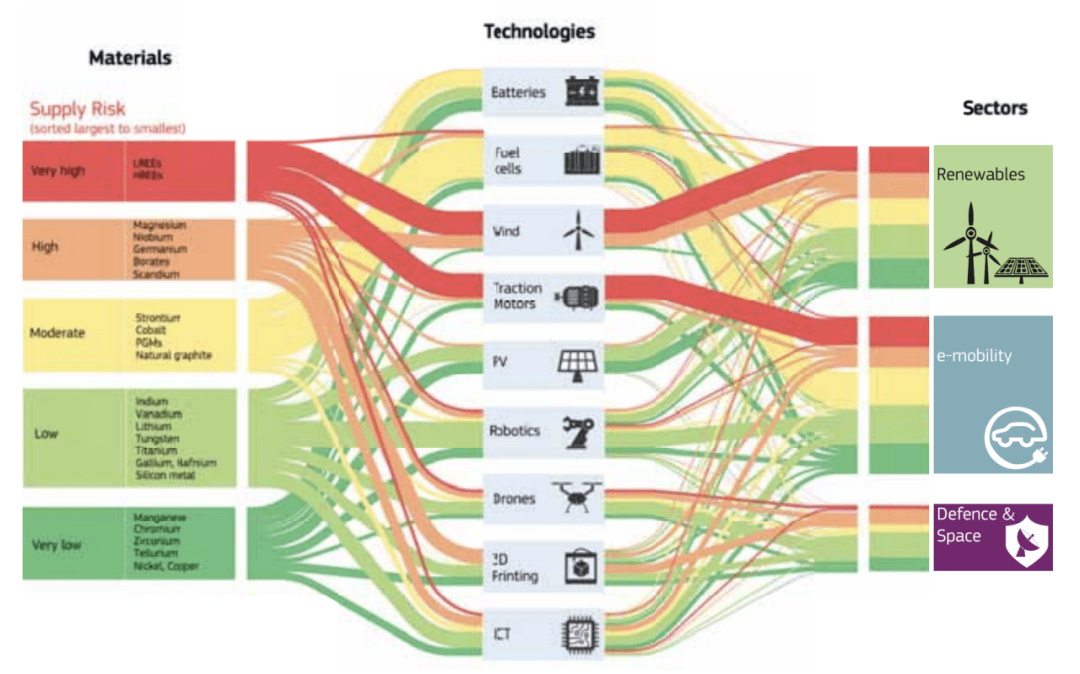

European Commission President von der Leyen said in September that the EU needs to strengthen ties with reliable countries and key growth regions, and ensure the supply of lithium and rare earths to drive the transition to a green economy. She will push for the ratification of trade deals with Chile, Mexico and New Zealand, and work to advance negotiations with partners such as Australia and India. The EU needs to avoid becoming dependent on oil and gas in the transition to a green economy, she pointed out that we currently process 90% of rare earths and 60% of lithium. The European Commission will introduce new legislation, the European Critical Raw Materials Act , to identify potential strategic projects and build reserves in areas at risk of supply. Whether it will be like the IRA in the United States in the future, we all need to discuss.

▲Figure 8. The world has become different

Summary: For your reference, I feel that the road to the rise of the industry is full of thorns and cannot be rushed for a while. There needs to be a more holistic view of the problem.

Post time: Oct-15-2022